04/12/ · 04/12/ · Share ideas, debate tactics, and swap war stories with forex traders from around the world US Dollar / Chinese Offshore Spot: USDCZK US Dollar / Czech Krona: 3: 4: USDHUF US Dollar / Hungarian Forint: 4: 5: USDMXN US Dollar / Mexican Peso: 5: 6: USDNOK US Dollar / Norwegian Krone: USDPLN US Dollar / Polish Złoty: 6: 7: USDRUB US Dollar / Russian Ruble: USDSEK Minor or Cross-Currency Pairs What are the Minor Pairs? Minor Pairs or Forex Crosses are Forex pairs that do not contain the US Dollar. Some of the minor pairs are very popular and very active in the Foreign Exchange market. The most active minors include Euro on one side (EURGBP, EURJPY, and EURCHF).» Learn about the Forex Majors 1. EUR/GBPEstimated Reading Time: 2 mins

Major Currency Pairs, Minors, Crosses in Forex

Currencies are traded around the clock 24 hours a day, 5 days a week. As the most liquid market in the world, high volume trades can be executed with no slippage. These can be positive or negative depending on the currency pair traded.

Gain a much larger market exposure with a relatively smaller initial deposit. Remember, with leveraged trading, the potential for profits or losses from your initial outlay of capital is much higher than in tradition trading. All of our other instruments are also quoted at the best possible prices from our liquidity providers. With an average execution time of 85 milliseconds, your trades are routed directly to our servers and executed automatically, with no dealer intervention.

Because of our ultra-fast execution and price feeds, there are no re-quotes when trading with us whatsoever. Your order will always be executed at the requested price — instant orders, every time. We are currently using a number of renowned liquidity providers. This allows us to offer you the best possible prices, execution and market depth, spot forex minor. Even high volume trades can be executed with the lowest possible slippage, spot forex minor to our advanced market solutions.

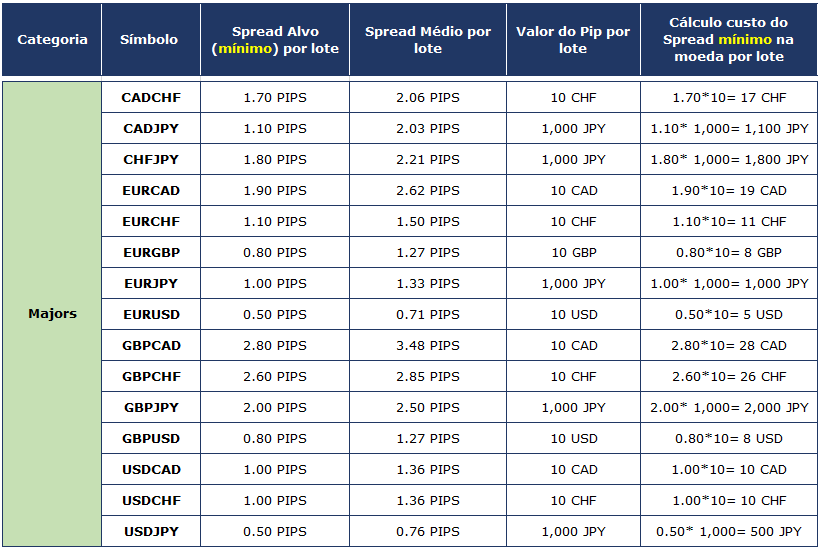

Range of markets. Why trade Forex with °Capital? Over 50 spot Forex CFDs °Capital offers trading access to major, minor, and emerging pairs 24 hours a day, 5 days a week.

Leverage Up to Gain a much larger market exposure with a relatively smaller initial deposit. No re-quotes Because of our ultra-fast execution and price feeds, there are no re-quotes when trading with us whatsoever. Deep spot forex minor We are currently using a number spot forex minor renowned liquidity providers. Why Globex°? Ready to get started? Open a live account or try our services with a demo account, spot forex minor.

Open a live account. Open a demo account. Client Area. Start Trading. Why °Capital? About °Capital. Meet The Team. Traditional Accounts, spot forex minor. Islamic Accounts. Business Referrer. Knowledge Base.

Range Of Markets.

Forex Trading for Beginners #2: What are the Major Currency Pairs by Rayner Teo

, time: 5:38Major vs Minor vs Exotic Forex pairs | Brokersome!

US Dollar / Chinese Offshore Spot: USDCZK US Dollar / Czech Krona: 3: 4: USDHUF US Dollar / Hungarian Forint: 4: 5: USDMXN US Dollar / Mexican Peso: 5: 6: USDNOK US Dollar / Norwegian Krone: USDPLN US Dollar / Polish Złoty: 6: 7: USDRUB US Dollar / Russian Ruble: USDSEK Minor or Cross-Currency Pairs What are the Minor Pairs? Minor Pairs or Forex Crosses are Forex pairs that do not contain the US Dollar. Some of the minor pairs are very popular and very active in the Foreign Exchange market. The most active minors include Euro on one side (EURGBP, EURJPY, and EURCHF).» Learn about the Forex Majors 1. EUR/GBPEstimated Reading Time: 2 mins 04/12/ · 04/12/ · Share ideas, debate tactics, and swap war stories with forex traders from around the world

No comments:

Post a Comment