![[Download] Market Makers Method – Forex Trading Course {GB} – Courses Download Archive market makers forex pdf](https://forexpops.com/wp-content/uploads/2018/09/Market-Maker-Method.png)

the late s, retail market maker brokers (i.e. Forex Capital Markets/FXCM) were allowed to break down the large interbank units in order to offer individual traders the opportunity to participate in the market. © MARKET TRADERS INSTITUTE. ABEGINNER’S"GUIDE"TOFOREX"TRADING:"THE"10KEYS"TO"FOREX"TRADING File Size: 1MB 29/04/ · Market Makers Method Forex Strategy (BTMM Simplified)PDF. April 29, DOWNLOAD THE MARKET MAKERS FOREX STRATEGY BY blogger.com FOR FREE HERE. This method is derived from the teachings by Steve Mauro. Many have watched the videos but fail to fully grasp the concepts as there are many and there is a lot of information to retain Forex trading for beginners pdf. According to the Bank of International Settlements, foreign exchange trading increased to an average of $ trillion a day. To simply break this down, the average has to be $ billion per an hour. The foreignEstimated Reading Time: 17 mins

Everything Forex - Forex Trading for beginners

edu no longer supports Internet Explorer. To browse Academia, market makers forex pdf. edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser.

Log In with Facebook Log In with Google Sign Up with Apple. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF. The Market Maker Method Private Study Notes from Seminar of Steve Mauro no.

Rashid Mehmood. Download PDF Download Full PDF Package This paper. A short summary of this paper. The Market Maker Method Private Study Notes from Seminar of Steve Mauro. Small people do that, but the really great make you feel that you too can become great. The sole goal of the MM is to make a market makers forex pdf. The only tools at its disposal relate to manipulating price. Price is a reflection of the number of transactions and the price paid for these transactions.

A large number of transactions are required to shift the price. The bulk of the transactions are carried out by large institutions, not by small traders. Therefore, the bulk of transactions made by small traders will be made with larger institutions.

This also means that a price is moved predominantly as a result of what the large institutions are doing with currency. Their ability to dominate the market is overwhelming. It costs about 10, market makers forex pdf, lots to move the market by one pip. So for a retail trader to be truly successful, they need to at least have a concept of this process so that they understand what is happening and why. Put another way, the same number of traders would be required to initiate a transaction at more or less the same time in the same direction to move the market.

So once you realise that price is moved as a result of deliberate, logical decisions the idea that price is a product of the emotional feeling of the various traders involved or of sentiment is misguided. Retail traders then, are left to react to the prices that they see, many of whom react emotionally. In relation to learning and using this material, it involves changing the way you think about the market and it will be necessary to do the homework, absolutely essential to learn to spot the patterns.

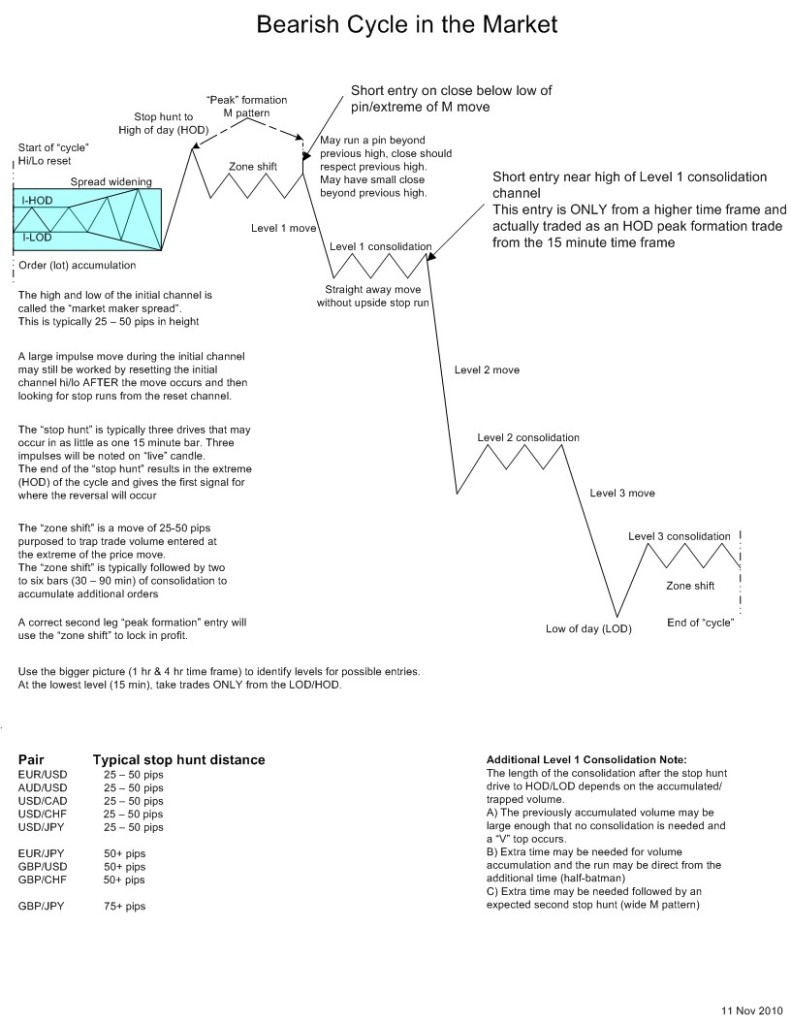

So rather than trying to trade everything that moves aim to be extremely selective and then make as much as you can from that move. This of course involves trading heavily on these highly selected setups. Then identify all the features of the 3 tiered cycle within both on a 3 day and an intraday cycle. Understand that they will not all looked perfect but nonetheless there are variations on the theme and being able to identify the variations is fundamentally important.

EXERCISE 2 Examine one or more cycles and put yourself behind the screen. In other words, imagine you are the market maker and what you would need to do at different times to trap traders and book your own profit, market makers forex pdf. You will need to consider "where the money is", what might drive traders to behave in certain ways and then consider the methods that have been put forward including circular trading, stop hunting, testing patience, and so on.

EXERCISE 3 Choose a pair, one of the majors, go back and look at the course of 5 to 10 days of trading and try to identify the key features. The features need to include: 1. Peak formation highs 2. Peak formation lows 3. Midweek reversals 4. Levels I, 2 and 3 with their consolidation levels 5. The market makers forex pdf cycle 6. The US reversals 7, market makers forex pdf. Areas where peak formation highs and lows correspond with intraday reversals EXERCISE 4 Make a list of all of the patterns, features and characteristics that have been discussed.

Create a market makers forex pdf or description for each of them. EXERCISE 7 Use TDI in the context of the MM pattern and mark up the entry and exit signals based on TDI EXERCISE 8 Find and identify examples of the Straightaway Trade. Mark them out, particularly looking for previous trap moves and the levels. EXERCISE 9 Describe the processes and patterns of a 24 hour trading cycle. EXERCISE 11 Create a MMM Checklist that relates to the trades you will be looking for, the specifics of your scanning, and how you will be taking those trades, including money management, profit targets and so on.

The equities open is at AM ET and this is an important place to start looking for the NYC reversal. Note 2, market makers forex pdf. The Gap time refers to a changeover period between markets and this is market makers forex pdf a quiet period and represents a period when one markets office sets up plans with the opening markets office. In trading currencies, market makers function as intermediaries in sales and purchases between two parties and two currencies.

For example a bank will function as a market maker when it collects sellers of the US Dollar to then sell to investors who have Euros in exchange. The value of each currency is based on the current market value, market makers forex pdf. To market makers forex pdf the MM you need to understand the basic objectives of their activity.

This includes strategies to trade against retails traders. The major difference between them and other traders is that they have the ability, through access to massive volumes, to move price at their will. So to make money, they aim to buy at a lower price and then sell at a higher price. They achieve this by: 1. Inducing traders to take positions. This means that the MM can sell a specific currency at a certain price and then buy it back at a lower price when the retail trader feels too much pain from the currency value moving backward and wanting to sell it back again e.

via the stop loss 2. Create panic and fear to induce traders to become emotional and think irrationally. Hit the Stops and Clear the Board. Even though they have a number of tools at their disposal, they do have some restrictions imposed on them from outside authorities.

These include: 1. The IMF restricts their ability to move price to a general range so as to avoid a collapse of the market. This is generally limited to the ADR and market makers forex pdf involve moves of as much as pips per day in most pairs. They do not have unlimited equity so it is necessary for the market- makers to close positions and regain balance periodically.

The only tools they have are to be able to buy or sell currency in different volumes at different prices, market makers forex pdf. By doing this strategically, they can: 1.

Entice traders to take positions by providing evidence that price is or is going to move in a certain direction. Appeal to the emotional side of traders by changing the character and speed of price changes, market makers forex pdf. Once the trap has been set, and market makers forex pdf bait taken, cause the price market makers forex pdf move in such a way as to cause price to move against the traders, allowing the banks to buy currency back from or sell currency back to the traders so that they are square again.

This means that the trader has entered the market by buying currency from the bank at a given price and exited the market by selling back to the bank at a lower price. Conversely, the bank has sold to the trader at the higher given price and bought back from the trader at the lower price. While these price movements are used to trap traders into unfavourable positions, they are not used 24 hours a day, but will be used more at certain times.

The patterns are most commonly observed in the following time periods : 1. The beginning of the season quarterly 2. The beginning of the day 4.

The beginning of the session 5. The end of the session 6. The end of day 7. The end of the week 8. The end of the season. Sometimes immediate price movements are designed and used to "cover-up" the MM is price movement. The rumour mill also has a role to play in generating a public expectation of price movement. It is not uncommon to see the general news being particularly pessimistic for example about a particular currency only to see the currency rise against it but usually after people have been trapped in line with the sentiment.

WHAT T OOLS DO T HE DEALERS AND Market makers forex pdf HAVE? Brokers and dealers have mechanisms available to them for manipulating price to enable the process of taking money from traders, who are also their clients!

They have a number of additional tools at their disposal and include: 1. Requoting 2. Trigger all stops in a given price range which is part of the dealers functions in the MT4 platform 3. Vary the spread which is why scalping methods often fail at times when it is an advantage to them to do so. Throw a price spike to take stops out, bear in mind that they know where the stops are.

Again bear in mind that they know who is in trouble because it is part of their backend platform. It is also normal to expect that this will entail a journey of 3 pushes or candles to get there.

Forex Market Maker Strategies REVEALED !

, time: 17:05

30% of forex industry was held by the individuals. 30% of $7 million industry means a big amount. I further searched about this forex market and got to know that it is online business now. It means anyone can be a forex trader while sitting at home in front of computer. Apparently forex market doesn’t have any common points with what we studyCited by: 2 By market convention, foreign exchange trades settle two mutual business days (T + 2) after that trade date unless otherwise specified. This is commonly referred to as value for spot. The spot exchange rate is the benchmark price the market uses to express the underlying value of the currency the late s, retail market maker brokers (i.e. Forex Capital Markets/FXCM) were allowed to break down the large interbank units in order to offer individual traders the opportunity to participate in the market. © MARKET TRADERS INSTITUTE. ABEGINNER’S"GUIDE"TOFOREX"TRADING:"THE"10KEYS"TO"FOREX"TRADING File Size: 1MB

No comments:

Post a Comment