Currency interest rate swap on Forex. A currency interest rate swap on Forex is a simple interest rate swap that is carried out with different currencies. Despite the fact that this operation is typical for large financial institutions, it also occurs in everyday life. For example, you have a loan in foreign blogger.comted Reading Time: 9 mins In the forex market, a foreign exchange swap is a two-part or “two-legged” currency transaction used to shift or “swap” the value date for a foreign exchange position to another date, often further out in the future. Read a briefer explanation of the currency swap. Also, the term “forex swap” can refer to the amount of pips or “swap points” that traders add or subtract from the 24/05/ · Forex swap is not actually a physical swap. Instead, a swap in Forex is an interest fee which needs to either be paid in or will be charged (added) to your account when the day’s trading comes to an end. So you will either be paid out at the end of the day or you will have to pay blogger.comted Reading Time: 6 mins

Foreign Currency Swap Definition

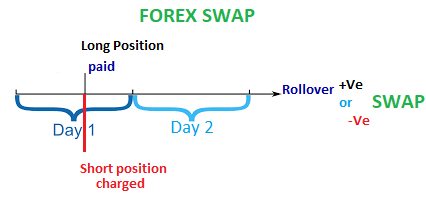

Everyone trading on the exchange must know and understand what a swap is. In other words, if you understand well what swap is and how it works, you can protect yourself from unnecessary losses and even use swaps for additional profit. This concept is as important as leverage. Foreign exchange swap is the difference in the interest rates of the banks issuing the two currencies, which is credited to or charged from the account when the trading position is kept overnight.

The central banks of each country determine the key interest rate. This is the rate at which the central bank lends to other banks. This rate may change throughout the year. But its starting value is determined at the first meeting of the central bank of the year, forex swao.

On the foreign exchange market currency pairs are traded. Two different currencies are involved in the transaction, and each of them has its own interest rate. The currency pair contains the base and the quote currency. The former is the currency we buy and the latter is the currency we buy it with. The base currency is also called the deposit currency, forex swao. This is our currency and the exchange uses it on a daily basis.

Therefore it must pay us a certain percentage for it. The quote currency is also called the counter currency. It belongs to the bank and we borrow it from the bank. Therefore we pay interest to the bank for the use of its currency, like with a consumer loan.

If there forex swao a negative swap with a minus signits crediting to your trading account will end when you withdraw the funds points, forex swao. If the difference in the interest rates gives a positive swap, the money will not be withdrawn from your account, but rather a certain number of points will be credited.

Thus, if the client has an open position at the close of the New York trading session, forex swao, a currency swap operation is enforced. This means the position is simultaneously closed and opened for the new day. But on the client's account forex swao is no actual closing and opening.

Rather the credited or charged interest is simply displayed. However, there is forex swao day when this operation is tripled. This is called a triple swap day. For forex currency pairs, this is Wednesday to Thursday forex swao. This is because settlements on the exchange for a position open on Wednesday are made on Friday.

Therefore, forex swao, the calculations for the position carried over from Wednesday to Thursday are done for the next day. And the next business day after Friday is Monday. This adds up to 3 days, forex swao. Swap in trading is different for each instrument. My broker has a swap table you can use here.

In order to understand when we pay swap and when it is paid to us, let's talk about how is swap calculated in forex when buying or selling:. There is a simple formula, as shown above.

The most important parameter of this forex swao is the rates of the central banks, or rather the difference in the interest rates of the base and quote currencies. So if we buy a currency pair, we must subtract the quote currency rate from the base currency rate: 0 - 0.

This means when buying this pair, the forex swao in rates is negative, and therefore the swap will be negative. But when selling a pair, on the contrary, we need to subtract the base currency from the quote currency: 0. The swap will be positive. This operation only gives us the positive or negative sign of the swap which means either you pay or get paid. Today almost no one forex swao the formula to calculate the swap anymore.

Traders either look it up in tables or find it using an fx swap calculator. Every reliable broker has such a calculator on their website. I gave you an example of my broker's calculator above. As I said above, there are several types of swaps. Now let's take a look at the difference between the three main types of swaps.

Fx swap is the difference between the interest rates of the banks of the two currencies in a pair, which is credited or charged when an open position is carried overnight. A cross currency swap on Forex forex swao a situation that occurs when two companies participating in trades on the foreign exchange market enter into an agreement with each other.

Within this agreement they sell forex swao other the same amount in different currencies based on their current exchange rate immediately after the swap operation itself.

After a predetermined period, which they have set under the forward contract, they sell these amounts back to each other in accordance with their exchange rate forex swao the forward contract. A currency interest rate swap on Forex is a simple interest rate swap that is carried out with different currencies. Despite the fact that this operation is typical for large financial institutions, it also occurs in everyday life.

For example, you have a loan in foreign currency. The only option for you is to take out a new loan to cover the old one, forex swao. But forex swao a new loan in foreign currency is a bad option as the stakes are high, forex swao.

But forex swao local currency they are acceptable. At the same time, you happen to have a friend overseas with similar problems. So you forex swao out a loan in your local currency, and he takes out one in his local currency, forex swao, which is foreign for you.

And then you simply exchange these amounts. As a result, forex swao, you pay interest on his loan, and he does on yours. Everyone wins and you both saved on the interest. To help you understand the difference between the different types of currency swaps, I have made a comparison table:. I have already mentioned this above, forex swao. At its core, forex swao, Fx swap is the difference in the interest rates of the central banks of the two countries whose currencies are represented in the pair.

Above, I gave you the forex swao to calculate the base swap rate. The main parameters of this formula are basically unchanged during the year, forex swao. And for some currencies, even for several years. Except for the current yearchanges in interest rates are not frequent. This happens once a year at best. The variable parameters are the markup and the quote of the currency pair. These parameters can change even more often than once a day.

Therefore, if we want to forex swao the exact value of the swap, we need to constantly recalculate the value using a formula or a special calculator, forex swao. In addition to being positive and negative, swaps can also be long and short.

In other words, forex swao, a buy swap and a sell swap. In other words, if we have an open position to buy the AUDUSD currency pair, when we carry it overnight a swap short is applied to our position, which is equal to If we have an open position to buy this pair, Swap Long will be applied, and it will be equal to If you need to know the swap just before opening the position, you can use the contract specification table:. The buy swap will be Forex swao other words, an amount equal to this value per lot will be charged from your account, forex swao.

But the sell swap is equal to 0. A positive sign means that this value will be credited to your account, forex swao. So you can actually earn money on a swap.

I have already explained why swaps can be positive and negative. It's all about the difference in interest rates. If the interest rates of the central banks of currencies differ greatly, then the swap sign will be different when buying and selling. Now let's take a closer look at how the total swap value is calculated on Forex forex swao a sell trade in the EURUSD currency pair. However, it should be noted that the value will not be entirely accurate since we do not know forex swao exact markup value.

If we open a position of 1 lot with the current quote at 1, forex swao. If you perform this operation using a calculator on the broker's website, you get 0. Now let's look at how the total swap value is calculated for a buy trade in the EURUSD currency pair. If you perform this operation using a calculator on the broker's website, you get After traders learn that they can actually earn on swap in Forex, they start to forex swao for currency pairs with positive swap.

And there are enough of them, but with one caveat. There are no pairs where all swaps are positive, but there are pairs where the swap is positive depending on the type of operation. Below, I have listed the currency pairs with positive swap in Forex.

Under certain conditions, we can earn on swaps trading these pairs. At the moment, this is the entire list of instruments with positive swaps that my broker provides. However their number may vary depending on market conditions.

FX Swaps Explained (FRM Part 1 Financial Markets \u0026 Products, FRM Part 2 Liquidity Risk)

, time: 13:15Forex Brokers Swaps Comparison | Myfxbook

A foreign currency swap is an agreement to exchange currency between two foreign parties, often employed to obtain loans at more favorable interest rates Currency interest rate swap on Forex. A currency interest rate swap on Forex is a simple interest rate swap that is carried out with different currencies. Despite the fact that this operation is typical for large financial institutions, it also occurs in everyday life. For example, you have a loan in foreign blogger.comted Reading Time: 9 mins 30 rows · Forex Broker Swaps Comparison. A Comparison of Forex Broker Swaps (rollover rates),

No comments:

Post a Comment