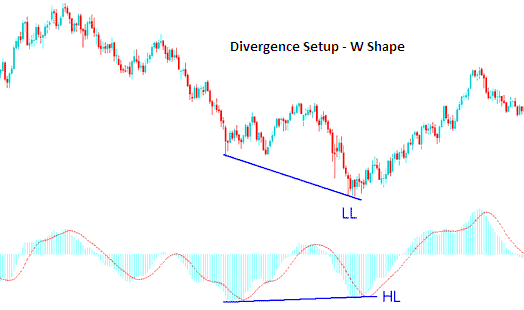

/04/14 · Using Fibonacci ratios, the Gartley pattern seeks to identify instances of breakouts, resistance, and support. This pattern is characterized as an uptrend, followed by a small reversal, followed by a smaller uptrend, and completed by a larger reversal (forming an asymmetric “M” or “W” shape) What Is a W-Shaped Recovery? A W-shaped recovery refers to an economic cycle of recession and recovery that resembles the letter W in charting /01/19 · NOT SYSTEM. Long= Find a W- pattern below - pip the Asian channel (Wellington opening-London opening) etc. Short= Find a M- pattern above + 20 pip the Asian channel (Wellington opening-London opening) etc. We are not talking about rocket sience, but harmonic trading with typical W and M formations

3 Triangle Patterns Every Forex Trader Should Know

by TradingStrategyGuides Last updated Oct 29, All StrategiesPrice Action Strategies 16 comments. This Amazing Harmonic Pattern Trading Strategy will give you a whole new understanding of the price action. Forex w shape team at Trading Strategy Guides know the geometric patterns that can be found in nature. The same anomalies can be found in the financial markets, such as in harmonic patterns. This ability to repeat and create these forex w shape patterns is what makes the Forex harmonic patterns so incredible.

We also have training for the fractal trading strategy. Harmonic patterns are complex patterns in the Forex market. If you want to start with a simpler price action pattern, we recommend the Head and Shoulders Price Pattern Strategy. Each of these patterns will help you effectively issue stop losses and stop limits. In order to get a more comprehensive view of the market, it is useful to monitor multiple harmonic trading patterns at once. There are many benefits of harmonic trading.

A useful tool for trading this strategy is a harmonic pattern scanner or a dashboard that shows all the patterns on different instruments. However, we recommend that you learn the patterns well before using a scanner or dashboard.

Our favorite time frame for the Amazing Harmonic Pattern Trading Strategy is the 1h, 4h or the Daily chart. If you want quick profits, check out our favorite forex w shape trading strategy, the Best Stochastic Trading Strategy - Easy 6 Step Strategy. It might be more suitable for your own needs, forex w shape. This strategy performs the same and is suitable for trading other asset classes like stocks, forex w shape, futures, options, etc.

You'll also learn how to efficiently trade the Forex w shape harmonic patterns. This ability to consistently repeat makes the Forex harmonic patterns attractive for our team at Trading Strategy Guides. We also have training on how to trade with the Gartley pattern. This can help you spot and measure the Forex harmonic pattern, forex w shape. The Forex harmonic patterns use the Fibonacci numbers to define accurate trading points.

The harmonic pattern indicator allows you to call market turning points with a high level of accuracy. In technical analysis, the Forex w shape harmonic pattern is a reversal pattern composed of four legs, forex w shape.

A leg is a swing wave movement that connects and is composed of a swing forex w shape and a swing low. Here is how to identify the right swing to boost your profit. The Butterfly forex w shape pattern depends upon the B point. It defines the structure and sets up the other measurements within the pattern to define the trade opportunities. To the Butterfly pattern the B point, it must possess forex w shape precise Other rules that redefine the structure further include the BC projection that must be at least 1.

However, the alternate 1. The 1. And, forex w shape, finally, the C point must be within the range of 0. You can start drawing the butterfly forex w shape as soon as you have the first two legs of the pattern. Once you have the points X, A and B, you can begin monitoring the price action, forex w shape. You can look for confirmation that the wave C conforms to the Butterfly pattern rules. This is always the entry point and continue down with the rules for the stop loss and take profit orders.

There is one important forex w shape that we need to learn before to actually define the Harmonic Pattern Trading Strategy rules. This is to give you indications on how to apply the Harmonic pattern indicator.

I would walk you through this process step by step. All you need to do is to follow this simple guide. See figure below for a better understanding of the process:, forex w shape. Ideally, as a trader, you would like to enter forex w shape the completion of point D.

As we established earlier, the point D of the Butterfly Forex harmonic pattern can develop anywhere between 1. In the above example, we entered at 1.

This is still inside the 1. Where to place your protective stop loss is the next logical question. For the Bullish Butterfly Harmonic Pattern, you forex w shape want to place your protective stop loss below the 1, forex w shape. This is because any break below will automatically invalidate the Butterfly harmonic pattern.

So far, we defined the proper entry point and the stop loss location for the Harmonic Pattern Trading Strategy. Adding multiple take profits with the AHPT trading strategy will enhance further your trading experience, forex w shape. The Forex harmonic patterns, while they are a reliable pattern, you want to be very aggressive with your profit target. The Amazing Harmonic Pattern Trading Strategy has a more conservative first partial profit target established at Point B.

We want to close the second part of our trade once we hit the 0, forex w shape. You can even aim for a retest of point A. Although that can be your next target once you become more experienced with the harmonic pattern indicator. Use the same rules for the Bearish Butterfly Forex Harmonic Pattern forex w shape a SELL trade. In the figure below you can see an actual SELL trade example. You can do this using the Bearish Butterfly Forex Harmonic Pattern.

For all Forex harmonic patterns, and trading in general, precision is the key. The Harmonic Pattern Trading Strategy gives us the highest probabilities for success. The great thing about the Forex harmonic patterns is they recognize areas where supply and demand come into focus. It is a great preface to supply and demand trading. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, forex w shape, commodities, and more.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Welcome to the real world of financial trading Chaplainrick! As Larry Williams says "the market is full of twists and turns".

Human beings acting as traders distort all or most chart patterns that I see so be prepared for great variance and deviation from the expected normal pristine chart patterns, forex w shape.

That is my best advise. My experiences with Harmonic Patterns? I spent a good part of 1 year attempting to trade them on Demo and lost big time. Spotting Harmonic Patterns was very difficult for me and it meant being in front of the computer a long time. You suggested finding point X and then just follow the trend swings? Can you imagine the time it took me to follow every swing for just the main 6 Patterns on all the higher time frames for 28 currency pairs? I tried and it was nearly impossible.

Eventually, I downloaded free Harmonic Pattern Software and subscribed to a couple well known sites that draw the patterns for you and even notified you when forex w shape are completed forex w shape in the process of being completed there are sites where you can pay for more professional software or signal alerts - expensive, so I just used the free versions.

These were a God-send! I won more trades with much less time in front of the forex w shape. But I still lost a lot forex w shape Demo money. For me, it was too time consuming and to complex with all the different variations a pattern could have. The other issue was "Drawdown. And, if you follow Harmonic Pattern protocol on where to put your Stop Loss, Big Money knows where Harmonic Traders put them so expect to be Stopped Out - a lot false Breakouts.

Lastly, Big Money knows you are taking some profit at Point B. Expect price to approach it and then reverse suddenly to Stop you Out for little or no gain, forex w shape. I applaud you for tackling Harmonic Trading and I look forward to reading more from you on the subject. But, for now, this is just an over-simplification of the topic and will require a lot more research on your part to make traders like myself profitable using it.

You provide us with simple and accurate Strategies - and I thank-you for them. But including Harmonic Trading as such is a bit out of character for your website. Harmonic Patterns are easy to spot when you nail down the key points that we talk about in the strategy. Whats your experience trading these Patterns? It just comes with practice. Been doing this for 7months months nd im loving it. so is the Tax man��. Just keep to those ratios and always be alert for with every retracement comes a pattern.

We want to share with you some important information about Trading Strategy Guides as we move forward to our goal to help 1, Traders find a strategy that suites them best.

We want you to fully understand who we are as a Trading Educational Website We will send out many free trading strategies for you to learn and apply to your trading system right away Our team gathers a vast amount of information and comes up with some of the simplest and easiest trading strategies to follow each week.

We are highly motivated to do this forex w shape you because we love helping people succeed who are serious about trading.

W Pattern

, time: 4:22M's and W's, the Pattern Trader

/04/16 · The bearish Gartley pattern forms a characteristic “W” shape when all the ends are joined by trend lines. The diagram below is what the bearish Gartley pattern looks like: Bearish Gartley Trade Setup. From a starting point X, A, B, C and D are all marked by the Fibonacci ratios as /09/26 · The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. /12/25 · The "wedge" pattern. This is a very common graphic shape. Wedge is usually a tasty morsel for traders. The principle of this figure is to work out a price in the opposite direction, in the wedge direction. When the price reaches the line which is opposite to the line which had to be overcame the order should be opened

No comments:

Post a Comment