Hence, the concept of Forex Market Hours derives from the notion that when major financial markets are open in a given time zone, the volume and liquidity in the market remains high, which in turn reduces the difference between the bid and ask prices and helps traders to fill their orders relatively easily without incurring slippage Forex Volume Indicator Strategy. Volume is a vital indicator for most traders and we can use it to add depth to our trading and increase our win rate. The most effective strategy for using a forex volume indicator is to use it in conjunction with key trading levels and price action. Forex volume can help paint a clearer picture of what is going on with price and what might happen in the future Forex Market Size, Volume And Liquidity. The Forex market is by far the biggest market in the world averaging a turnover of $ trillion dollars a day. Because of the giant size of the market, it is a great market for traders who want to make swing trades, scalp trades and day trade

How to Use Volume to Improve Your Trading

As a forex trader, using a volume trading strategy could be the best decision to make when aiming for profit maximization while covering your positions. The forex market presents you with myriads of possible trading strategies, but only the best at that time will amount to something good.

Volume trading strategies are ideal when you need to improve your current trading plan to increase returns. This article walks you through tricks to use when leveraging volume to set up winning strategies. In the first place, let us explain volume trading and why it is essential. Volume is a measure of the forex volume of a given forex instrument traded in the market over a specified time.

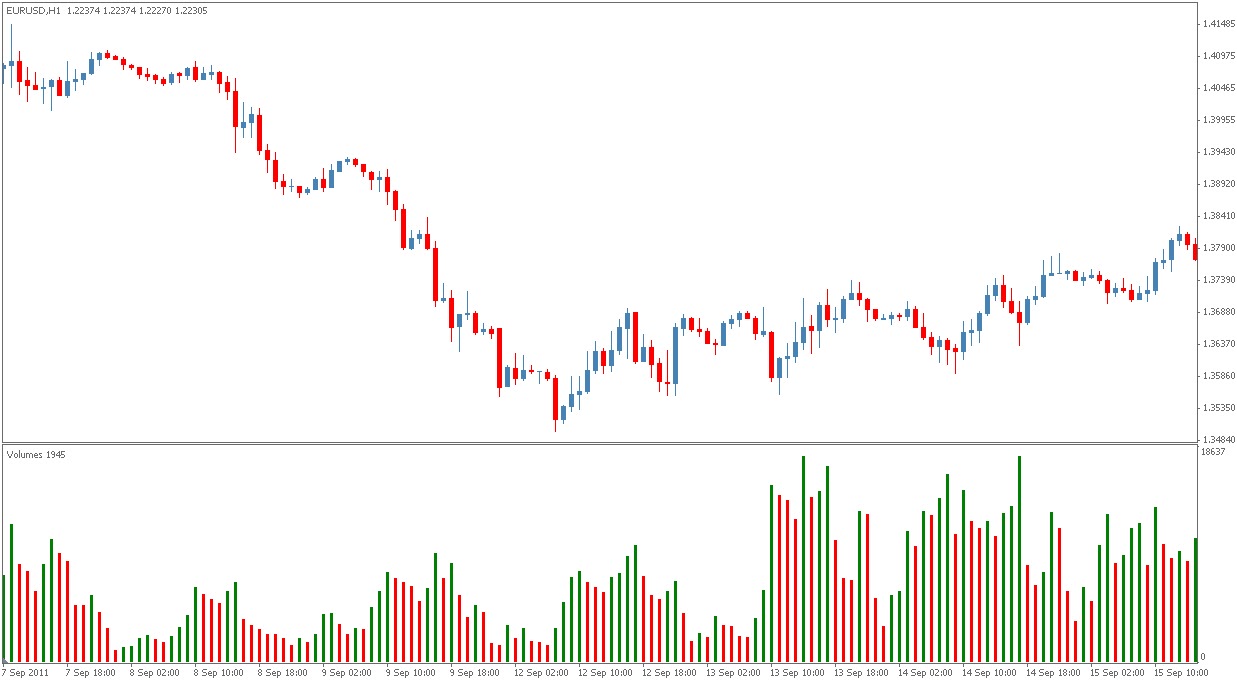

The market trades forex pairs at varying frequencies depending on the prevailing demand posture. Over time, the volume of forex instruments depicts patterns that one can track using volume indicators. Volume indicators paint a picture of the behavior of the demand for the forex volume instrument over the period in consideration. Volume data is critical during technical analysis.

Volume is more useful if you know how and when to use it. Here are some tips to guide you through volume analysis note that these guidelines are not absolute, and you might want to throw in additional indicators to confirm the signals :. A trend is useful when forex volume catch it early. But what happens when you go in early on what appears to be a trend formation only to find out it was a dead cat bounce? One way you can confirm trend formation is to observe the volume traded.

If the price appears to be climbing, but the volume looks weak, you better hold on because you could be heading into a bull trap, forex volume. If the price rises and volume enlarges, forex volume, then forex volume is an explicit confirmation of trend formation. Exhaustion moves refer to the price and volume spikes at the peak of a market where buyers rush in to grab a piece of the action before a price reversal.

It is an exhaustion move because it exhausts the number of buyers available to continue taking bullish positions. Such activities also happen during a sell-off.

When volume begins to decline after the spike, this could confirm that a trend reversal is in the offing. It is common for price to decline while volume advances, forex volume.

In such a case, forex volume, a keen trader will take the chance to go long because an advancing volume often shows that a price rally is just about to happen. After the price moves up, watch out for its next move — if it declines but stays above the previous low, then a bull session might have kicked in.

Successful trading means seeing in the future ahead of other players, forex volume, and volume could help you achieve this, forex volume. Volume comes in handy, especially when price action begins to plateau. If significant shifts in volume accompany price action plateaus but, forex volume, you should read this as a signal for forex volume potential reversal in price direction.

Otherwise, weak volume indicates a market that lacks interest in pursuing a breakout, which might end up being a dead cat bounce, forex volume. A volume forex volume strategy is incomplete, with a couple of indicators to help you gauge direction and momentum. They include:. Volume trading is one of the best strategies in forex volume because the quantity of an instrument moved in a given time reflects the buying and selling pressures in the market.

As such, forex volume, the strategy is ideal for detecting trends and price reversals. Traders can also use volume to see false breakouts, as well as exhaustion moves. Indicators such as Klinger oscillator, OBV, and MFI are useful when designing a volume trading strategy. Save my name, email, forex volume, and website in this browser for the next time I comment. Click or touch the House.

Check out our list of best forex robots. RELATED ARTICLES MORE FROM AUTHOR. How Forex volume Shift Forex volume Trading Styles Easily, forex volume. Forex volume to Set up a Successful Family Office in Forex.

LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address! USD - United States Dollar. You must be aware and willing to accept the risks to invest in the markets. Never trade with money you can't afford to lose. Past performance of any results does not guarantee future performance. Therefore, no representation is being implied that any account can or will achieve the results indicated in this website, forex volume.

EVEN MORE NEWS. How to Navigate Your Way Through Margin Calls April 29, Lucky Gold Scalper Review. IndEX EA Review. Disclaimer Privacy Policy About Us Get In Touch.

Forex Volume Analysis 2021

, time: 18:24Foreign exchange turnover in April

The trading volume brought about by speculators is estimated to be more than 90%! The scale of the forex market means that liquidity – the amount of buying and selling volume happening at any given time – is extremely high. This makes it very easy for anyone to buy and sell currencies Hence, the concept of Forex Market Hours derives from the notion that when major financial markets are open in a given time zone, the volume and liquidity in the market remains high, which in turn reduces the difference between the bid and ask prices and helps traders to fill their orders relatively easily without incurring slippage 10/01/ · Volume can be an indicator of market strength, as rising markets on increasing volume are typically viewed as strong and healthy. When prices fall on increasing volume, the trend is gathering

No comments:

Post a Comment