Forex trading backtesting software can be a very useful tool for traders. Instead of spending weeks, experimenting with demo accounts, this allows traders to test dozens of strategies in a single day. Traders then can choose those techniques that prove to be the most effective on backtesting. START TRADING IN 10 MINUTES Backtesting software is a computer program that lets you test your trading strategies against historical data. The easiest way to look at this software is to consider it as a practice run for a theory or strategy that you want to develop using real data, but not using cash. There are some advantages and disadvantages to backtesting software, though. For example, one of the most significant upsides to Estimated Reading Time: 6 mins Top Backtesting Software for Testing Forex Strategies

Top Backtesting Software for Testing Forex Strategies

Forex backtesting software is a type of program that allows traders to test potential trading forex trading backtesting software using historical data. The software recreates the behaviour of trades and their reaction to a Forex trading strategy, and the resulting data can then be used to measure and optimise the effectiveness of a given strategy before applying it to real market conditions.

Backtesting trading strategies work on the assumption that trades that have performed successfully in the past will perform well in the future. Before I define 'backtesting', forex trading backtesting software, it will be helpful to discuss the history of backtesting first. Inbacktesting of a Forex system was a pretty straightforward concept. Traders would make their conscientious trades on charts, making the position either to 'buy' or 'sell'.

Then, they would manually write exhaustive notes of their trade results in a log. Most of the trade ideas came from a profound understanding of fundamental analysisor the awareness of market patterns. In the s, a person was considered an 'investing innovator' if they were able to display data on a computer monitor. The electronic process that allows us to check results online and gain confidence in our strategy today used to take months, even years, in the past.

However, technological advancements have simplified the entire process for us. Since then, the process has continued to advance, but not always for the better.

Those who apply diligence and common sense to backtesting trading strategies in Forex are usually in a better position to be rewarded with tremendous gains.

On the other hand, traders who only apply computing power and leave human logic out of the picture are likely to suffer huge losses, forex trading backtesting software. When it comes to backtesting FX strategies, no software can replace a human being — especially one equipped with the right tools.

Forex backtesting is a trading strategy that is based on historical data, where traders use past data to see how a strategy would have performed. The definition of a backtesting application is a set of technical rules applied to a set of historical price data, and the subsequent analysis of the returns that a Forex strategy would have generated over a specific period of time.

Forex trading strategies are applied to a set of price data, and trades are reconstructed using that data. This data can be used by traders to ascertain any unforeseen flaws in their current strategies.

Alternatively, new strategies can also be tested before using them in the live markets. Depending on the type of backtesting software used in Forex trading, traders can get a wide range of indicators, such as:. All these metrics provide you with insights into how your Forex trading strategies are performing.

The best backtesting software in Forex depends on certain variables that can affect the outcome of the entire process. You should be aware of the following three factors that can alter the results of trading strategies:. It is also important to consider whether you are using bar forex trading backtesting software or tick data. Tick data can allow near-perfect forex trading backtesting software simulation of your data.

This process is slower when including bar data. With bar data, for each time interval, you receive 4 price points. The longer the time-frame, the more accurate the results will be. Please note that even the best backtesting software cannot guarantee future profits.

Infrequent liquidity is a frequent issue in the Forex markets. It is governed by various external factors and is very difficult to simulate.

There is a range of backtesting software available in the market today. Each software type has its own way of evaluating Forex trading strategies. Forex backtesting can be broadly divided into two categories — manual and automated.

Traders also have the ability to trade risk-free with a demo trading account. This means that traders can avoid putting their capital at risk, forex trading backtesting software, and they can choose when they wish to move to the live markets. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders.

This involves a fair amount of work, but forex trading backtesting software is possible. In manual Forex backtesting, you just take the historical data and step through it, forex trading backtesting software. A charting tool will help you to go bar by bar so that you can observe the price action and subsequent performance metrics along the way. The advantages of manual backtesting include:. Manual backtesting methods can be a good way to start before you proceed to use automated software.

Using an excel spreadsheet for backtesting Forex strategies is a common method in this type of backtesting. Many traders believe that one shouldn't have to be a programmer or an engineer to backtest a strategy. This method takes us back to the very basics, which anyone can use. Spreadsheet programmes such as Excel are among the best ways to backtest Forex trading strategies for free. The time component is essential if you are testing intraday Forex strategies. To get the data, you can simply go to Yahoo Finance or Google Finance.

In the "Quotes" field, you will find the option to get historical prices for the symbol. Enter the date range here. Scroll down to the end of the page and click "Download to Spreadsheet". Use the "Sort" option in Excel's data menu to prepare the data. Here's a look at one way to find the day of the week that provided the best returns. Suppose, our strategy is "buy the open" forex trading backtesting software "sell the close.

You can also choose to include average and sum functions at the bottom of the "Weekday" column to find the most profitable day to implement this strategy over the long term. This is a strategy for backtesting using the manual option. You can use many expressions and conditional formulae like this for testing Forex strategies.

However, this method is tedious and time-consuming. One software that would be ideal for manual backtesting would be TradingView:. Launched inthe TradingView platform is a good option for free Forex backtesting software. This Forex trader software is best known for its advanced charting tools. Real-time data and browser-based charts make research from anywhere possible, since there is nothing to install, and no complex setups to be taken care of.

It is a social platform, where you can even share, watch or collaborate with other traders and publish your strategies on social media profiles like Twitter or blogs. One of the most useful tools for backtesting on this platform is the Bar Replay Feature. Source: TradingView. The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. However, the currency pairs that you forex trading backtesting software need to have enough historical data available for them.

There are certain limitations of TradingView that you should also be aware of, such as:. Automated backtesting involves the creation of programmes that can automatically enter and exit trades on your behalf. These programmes can be obtained free of cost online, forex trading backtesting software, although premium versions are available for purchase as well. One of the primary advantages of these tools is that they remove emotions from your trading activities.

Many traders often use these tools on copy trading strategies to enhance the chances of success. However, keep note that your programme has to match up to your personality and risk profile.

Also, not all trading methods can be used with automated strategies. Both MetaTrader 4 MT4 and MetaTrader 5 MT5 offer automated backtesting tools. Both MT4 and MT5 are proven and secure electronic trading platforms; popular choices for trading the financial markets. The indicator-rich MetaTrader 4 Supreme Edition plugin is the preferred option, owing to the additional features included that enhance the trader's experience.

MetaTrader 4 is popular for FX backtesting because of its in-built 'Strategy Tester' feature. The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. Orders can be placed, modified, and closed just like one would do under live trading conditions. Compared to Demo trading and other forms of Forex paper trading, trading on historical data can save a lot of time.

The speed of the simulation can also be adjusted, which will let you focus on the important time-frames, forex trading backtesting software. Additionally, you can boost the trading capabilities of your MetaTrader platform by downloading the MetaTrader Supreme Edition plugin for FREE!

This excellent plugin enhances your trading experience by providing access to technical analysis from Trading Central, real-time trading news, global opinion widgets, trading insights from experts, advanced charting capabilities, and so much more!

Click the banner below to download it for FREE! After you download MT4, you need to open the main menu and go to the "View" section where you will find the "Strategy Tester" option. This Forex simulation software is one of the best ways to backtest Forex trading strategies, both offline forex trading backtesting software online, forex trading backtesting software.

By default, it is locked in demo mode. Reports on EA Expert Advisor testing results have been significantly upgraded on MT4 recently. Traders can now analyse ratios such as the Sharpe ratio, the recovery factor, position forex trading backtesting software times, and many other characteristics, over 40 different characteristics can be analysed in the 'Strategy Tester' report.

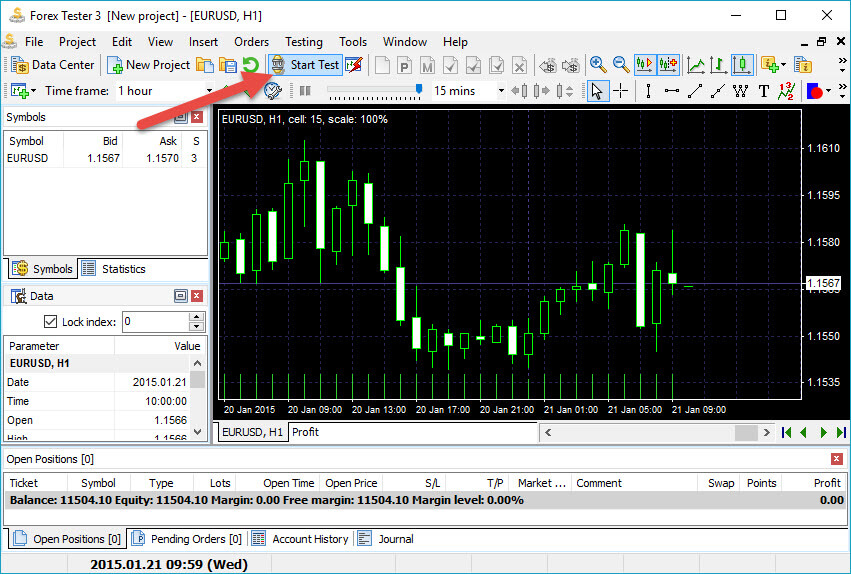

Another popular forex strategy backtesting option on MT4 is 'Forex Tester'. Unlike Forex trading backtesting software Tester, Forex Tester is not free and can be used both for manual and automated trading activities.

This automated backtesting software provides traders with pre-formed strategies. It has 10 manual programs and 5 expert advisors, along with 16 years of historical price data, and a risk calculation and money management table, forex trading backtesting software. Source: Forex Tester. Among the best Forex trading software that are designed to achieve consistent profits, MT4 also allows you to backtest Forex strategies easily.

After importing the historical data, you can simply click on "Start Test" to forex trading backtesting software backtesting strategies. The "Start Test" button will change forex trading backtesting software "Stop Test" automatically.

Soft4Fx: The Forex Best Backtesting Software Thus Far! - Forex Simulator Review

, time: 35:22Forex Backtesting Software - Which Is Best?

30/04/ · Best Overall Software. Forex Tester 4; Soft4X; TradingView (paid) MetaTrader 5; ThinkTrader; Tie: NinjaTrader 8 and TradingView (paid) Forex Tester 4 is still the best Forex backtesting software for manual testing. I can’t say that I’m blogger.comted Reading Time: 7 mins Backtesting software is a computer program that lets you test your trading strategies against historical data. The easiest way to look at this software is to consider it as a practice run for a theory or strategy that you want to develop using real data, but not using cash. There are some advantages and disadvantages to backtesting software, though. For example, one of the most significant upsides to Estimated Reading Time: 6 mins Top Backtesting Software for Testing Forex Strategies

No comments:

Post a Comment