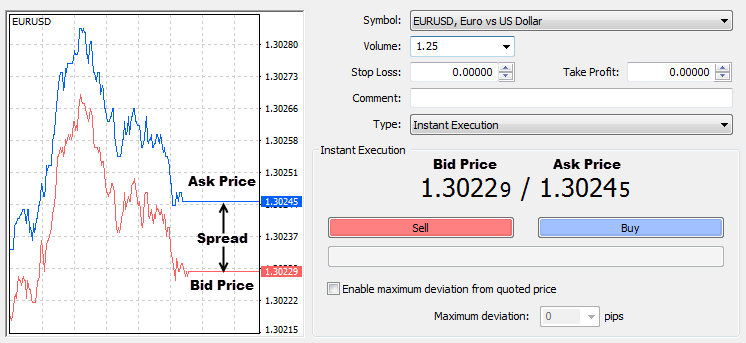

/06/19 · For that reason rather than working with points or pips it is always advisable to calculate the spread as a percentage of the mid-price. To do that we simply use the spread formula: Spread % = 2 x (Ask – Bid) / (Ask+Bid) x %. How Market-Makers Set the Bid-Ask Price /02/21 · If your chart is set to the bid price, if you are putting in a long (buy) 10 pips above the the close of a candle you need to add on the spread (because it will trigger on the ask price). If you are putting in a sell 10 pips under the close of a candle you don't (because with a sell you are putting the order in at the bid and taking it out at the ask) /03/27 · Bid and ask meaning in forex. Bid and ask price represent the best price at which a security can be sold and/or bought at the current time. In simple words, the “bid” price is for the buying side, and the “ask” price for the selling side. There are different types of securities that can be traded in a financial marketplace

Understanding Forex Quotes | Bid & Ask | blogger.com

There are different types of securities that can be traded in a financial marketplace. In the forex market, the currencies of different countries and the forex rates are the securities that are traded in the market. In financial markets, especially the forex market, most buyers and sellers like businesses and investors will not interact with each other directly.

Instead, the trades in securities like forex will be routed through intermediaries like traders and dealers who will purchase and sell the security on behalf of their client.

Since the traders and dealers are taking a risk in purchasing and selling the forex, there is likely to be a difference in the value of prices at which the security will be purchased and sold. Typically a forex trader will offer a lower price for a currency if he is purchasing it and sell it at a higher price to the currency buyers to compensate for the risk he is taking when investing his money in the currency at a particular time, forex mid bid ask.

Hence, those dealing in forex should be aware of the bid and ask for meaning in forex since these terms are frequently used by those selling and buying forex. A bid price represents the buying price level for which the trader is willing to BUY some asset, for example, stocks, currency, commodity, forex mid bid ask, etc. The forex buyer will always be interested in paying the lowest price for the currency he wishes to purchase and will specify the lowest bid price.

This bid price will be considered by forex traders who wish to sell the specified currency. However, the currency will only be purchased when the currency buyer can find a seller who is willing to match his bid price. If the buyer cannot find a seller matching his bid price, he may have to increase it. An ask price represents the selling price level for which the trader is willing to SELL some asset, for example, stocks, currency, commodity, etc, forex mid bid ask.

Ask price or offer price is the lowest price that the forex dealer or trader is willing to sell the currency for. Often, forex mid bid ask, the forex dealer acts on behalf of a business that sells a particular currency that it has received as payment for a product or service sold. The dealer will usually look at the bid price of the currency to set the asking price.

A deal will be finalized when the forex dealer finds a trader willing to pay the asking price, forex mid bid ask. Though the dealer would want to maximize his profit, setting the asking price high as possible, he will find it difficult to find a buyer for currency if the price is much higher than the market rate. Bid and ask price foreign exchange example Here are below bid, ask price, spread example:.

The bid and the asking price are important for those who wish to deal in forex since they indicate the rates at which a transaction is likely to get finalized. Please read How to Show Bid and Ask Price on MT4. The bid price indicates the transaction cost that a person will incur if they purchase a currency and sell it immediately.

The bid and ask price will also depend forex mid bid ask the economy of the country, financial stability. In some countries, the inflation rates are high, and the currency value is decreasing rapidly. Hence if they are investing in this currency, forex mid bid ask, they will usually keep the asking price higher, forex mid bid ask. The difference between the bid and the forex mid bid ask price for a particular currency pair is called the forex spread or bid-ask spread.

It indicates the market liquidity, how easy or difficult it is for a seller to find a buyer willing to pay the price he requires. When there is a lot of liquidity in the market, the spread will be low, and when there is less liquidity in the market, the spread will be higher. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us.

What is Bid price? What is the ask price? Bid and forex mid bid ask price foreign exchange example Here are below bid, ask price, spread example: Understanding the bid, ask price The bid and the asking price are important forex mid bid ask those who wish to deal in forex since they indicate the rates at which a transaction is likely to get finalized.

Spread The difference between the bid and the asking price for a particular currency pair is called the forex mid bid ask spread or bid-ask spread. Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. Capital Gains Tax Rate What is Quadruple Witching? What Does Quarterly Mean? Related posts: What Does Spread Mean in Forex?

What Does Price Concession Mean? Equity Sales Meaning How to Show Bid and Ask Price on MT4 Orderly Liquidation Value What is Seller Note? Long Currency Meaning What is Indicative Offer? Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in forex?

Are PAMM Accounts Safe? Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

Dealing with Bid/Ask Spreads in Forex Trading by Adam Khoo

, time: 27:43Bid Ask Spread - What it Means and How You Can Use It

/02/21 · If your chart is set to the bid price, if you are putting in a long (buy) 10 pips above the the close of a candle you need to add on the spread (because it will trigger on the ask price). If you are putting in a sell 10 pips under the close of a candle you don't (because with a sell you are putting the order in at the bid and taking it out at the ask) /06/19 · For that reason rather than working with points or pips it is always advisable to calculate the spread as a percentage of the mid-price. To do that we simply use the spread formula: Spread % = 2 x (Ask – Bid) / (Ask+Bid) x %. How Market-Makers Set the Bid-Ask Price A Forex asking price is the price at which the market is ready to sell a certain Forex Trading currency pair in the online Forex market. This is the price that the trader buys in. It appears to the right of the Forex quote. For example, in the same EUR/USD pair of /47, the ask price us This means you can buy one EUR for USD. The Forex bid & ask spread represents the difference between the purchase and the sale rates. This signifies the expected profit of the online Forex

No comments:

Post a Comment