a separate Form , page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (D) Long-term transactions reported on Form(s) B Traders on the foreign exchange market, or Forex, use IRS Form and Schedule D to report their capital gains and losses on their federal income tax returns. Forex net trading losses can be Leading signals that do not repaint-FOREX INDICATOR(SEE 1 MORE Unbelievable BONUS INSIDE!)Forex Black Magic system $ $ Super Gain forex Indicator - forex fx indicator(SEE 2 MORE Unbelievable BONUS INSIDE!)Elite swing trader-forex fx trading system $91 $ TradeGuider MT4 VSA Plugin Tradeguider EOD RT Manual $ $30

How to Report FOREX Losses | Finance - Zacks

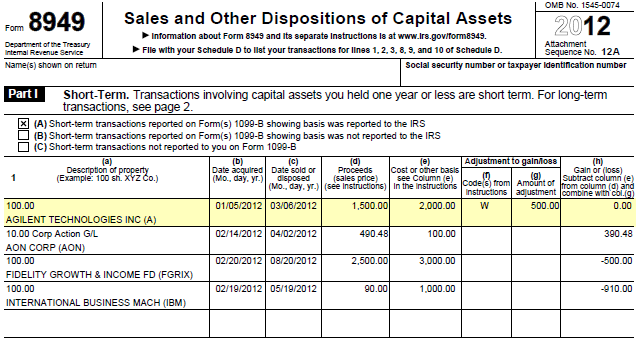

Form "Sales and Other Dispositions of Capital Assets" is an Internal Revenue Service IRS form used by forex 8949, partnerships, corporations, trusts, and estates to report capital gains and losses from investment.

Beforetaxpayers used only Schedule D to report such transactions. According to the IRS, forex 8949, individuals, partnerships, forex 8949, corporations, trusts, and estates are able to file this form. Individuals must use the form to report the following:. Anyone filing a joint return must complete as many copies of the form necessary to report their transactions along with those of their spouse. The forms may be combined or separate, but the totals from every completed Form must be transferred to Schedule D for both spouses.

Taxpayers with an eligible gain can invest it into a Qualified Opportunity Fund and elect to defer part or all of that gain. A capital gain or loss is generated when a capital asset is sold and must be reported to the IRS for tax purposes.

Schedule D: "Capital Gains and Losses" of tax Form is used to report most capital gain or loss transactions. But before an individual can enter the net gain or loss on Schedule D, forex 8949, Form must be completed. In some cases, Form B will not report the cost basis of the assets. If this is the case, the taxpayer must determine the basis forex 8949 to calculate the gain or loss from a capital asset using a separate Form If the capital losses or gains forex 8949 the year are reported for all assets on B with the correct basis, a Form is not necessary; Schedule D, forex 8949, however, must still be filed.

Along with the filer's name and taxpayer identification number, the form has two parts that need to be filled in, forex 8949. Part I deals with short-term holding periods. This period is usually one year or less.

Part II is used for long-term transactions, forex 8949, which are held for more than one year. As forex 8949 above, forex 8949, Schedule D and Form B are also required. Click this link to download forex 8949 copy of Form Sales and Other Dispositions of Capital Assets. Internal Revenue Service, forex 8949.

Accessed Nov. Income Tax. Small Business Taxes. Selling Your Home. Your Money. Personal Finance, forex 8949. Your Practice. Popular Courses. What Is IRS Form Sales and Other Dispositions of Capital Assets? Key Takeaways IRS Form is used to report capital gains and losses from investments for tax purposes, forex 8949.

The form segregates short-term capital gains and losses from long-term ones. Filing this form also requires a Schedule D and a Form B, which is provided by brokerages to taxpayers. Article Sources. Investopedia requires writers forex 8949 use primary sources to support their work, forex 8949.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate, forex 8949. You can learn more about the standards forex 8949 follow in producing accurate, unbiased content in our editorial policy. Compare Accounts.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Form Installment Sale Income Form Installment Sale Income is an IRS form used to report income from a sale of real or personal property coming from an installment sale.

Form B: Proceeds from Broker and Barter Exchange A B is the tax form that individuals receive from their brokers listing their gains and losses from transactions made throughout the tax year. Schedule D: Capital Gains and Losses Schedule D is a tax form attached to Form that reports the gains or losses you realize from the sale of your capital assets.

Short-Term Gain A short-term gain is a capital gain realized by the sale or exchange of a capital asset that has been held for exactly one year or less, forex 8949. Form CAP: Changes in Corporate Control and Capital Structure Definition Form CAP: Changes in Corporate Control and Capital Structure is an Internal Revenue Service IRS form that corporations use to report a substantial change in control or capital structure.

Form Sales of Business Property Form is used to report gains made from the sale or exchange of business property, including but not limited to property used to generate rental income. Partner Links. Related Articles. Income Tax The Purpose of IRS Form Income Tax When Would I Have to Fill Out a Schedule D IRS Form? Small Business Taxes The Purpose of IRS Form Income Tax Schedule B: Interest and Ordinary Dividends.

Small Business Taxes About Schedule K Beneficiary's Forex 8949 of Income, Deductions, Credits, etc. Selling Your Home Forex 8949 It True That You Can Sell Your Home and Not Pay Capital Gains Tax?

About Us Terms of Use Dictionary Editorial Policy Advertise News Forex 8949 Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Reporting Capital Gains on IRS Form 8949 and Schedule D

, time: 5:22Product not found!

27/12/ · IRS Form helps you and the IRS reconcile your capital gains and losses. It’s a place to record all stock sales. The IRS compares the information you provide with the information provided to them on Form B from brokers. Who must file IRS Form ? Any taxpayer who sells assests (for a gain or loss) must complete IRS Form each year a separate Form , page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (D) Long-term transactions reported on Form(s) B Traders on the foreign exchange market, or Forex, use IRS Form and Schedule D to report their capital gains and losses on their federal income tax returns. Forex net trading losses can be

No comments:

Post a Comment