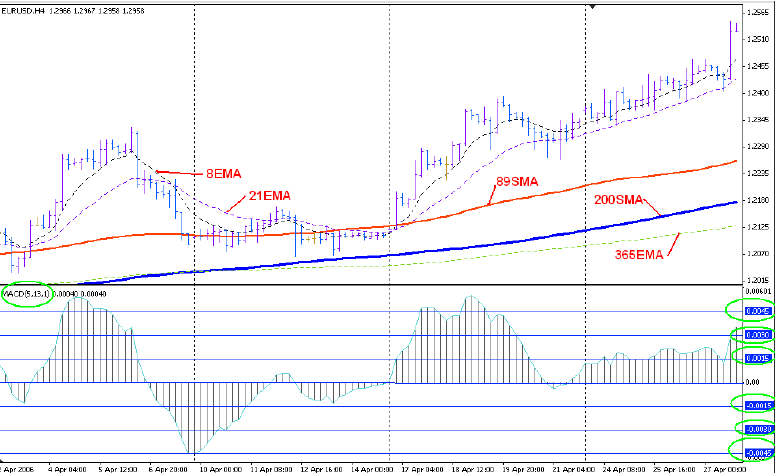

Our Very Profitable 4 Hour Chart Trend Following Strategy With this strategy, the main goal is to exploit the popular saying in the trading world “the trend is your friend”. This swing trading strategy uses a combination of moving averages, support and resistance, volatility and a few other tools to maximize profits from the trends in the Forex market H4 Forex Trading Strategy & Indicator in MT4 Download Free November 17, Strategy H4 means 4-hours which is related to trading strategy and it’s a combination of technical indicates which is based on 4 hour charts. This strategy is basically a profitable way for traders to trade and they can easily take advantage from trading screen The Four-Hour Trader, A Full Trading Plan

by TradingStrategyGuides Last updated Apr 30, Advanced TrainingAll StrategiesChart Pattern StrategiesForex StrategiesIndicators 0 comments. Learn the H4 forex trading strategy a cash-rich system to benefit from both the intraday price fluctuations and the larger time frames. If this is your first time on our website, our team at Trading Strategy Guides welcomes you.

Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. What time frame you trade on will largely determine how you calculate your support and resistance levels, your risk level and determine the trend direction.

Our goal is to focus on the 4-hour time frame namely because:. Probably the 4 hour chart is the best time frame for simple swing trading, forex 4 hour strategy. If you have a 9 to 5 job, or a family that keeps you busy, but you still want to make money from the forex market, we recommend trying the H4 trading strategy. Now, forex 4 hour strategy, probably most of you already know that in the forex trading and technical analysis realm, H4 is simply an abbreviation for the 4-hour daily time-frame.

The 4-hour time frame is an intraday TF where each corresponding candle encompasses exactly 4 hours of trading activity from open to close. Unlike stocks which are opened for trading for a limited 8-hour window, in forex trading, the foreign exchange market never sleeps. So, in the stock market, the 4h TF is useless as one full day of trading will be comprised of two 4h candles, forex 4 hour strategy.

However, in the forex market, one full day of trading activity forex 4 hour strategy comprised of six 4h candles.

What is even more important, one 4h candle point out to a half of each major trading sessions. In the forex market, forex 4 hour strategy, the Sydney, Tokyo, London and New York session have their unique price action.

And, this is where FX traders can focus on new trading opportunities. Trading on the 4h time frame is not only suited for those with limited time on their hands or the beginner traders, forex 4 hour strategy.

Check out our guide on the best trading strategy for beginners. Since time in the forex market is broken in several trading sessions and forex brokers run on different time zones, the 4h candle will close at a different time of forex 4 hour strategy day. The main disadvantage of the different FX broker server times is that you will get different 4h candle closing.

Every new candle on the 4h time frame is formed every 4 hours. This in turn will lead to different price actions on your 4h chart, forex 4 hour strategy. See below the difference between a 4h chart with a New York close and a chart with a different closing time. To resolve this issue, and have a more accurate representation of each trading session we use the New York close time to define when a new 4h candle is printed.

In forex trading, the New York close is considered the standard closing time for the day. Learn how to master forex forex 4 hour strategy with our complete guide.

The daily closing price in any market, be it forex, stocks, commodities or cryptocurrencies displays who won the battle between buyers and sellers for that session. Traders who are planning to use the h4 forex trading strategy need to have the correct New York closing charts. If you want the identical price action on your charts as we have them, you should use the New York close charts.

If forex 4 hour strategy use the correct New York close charts, you should see each 4-hour candle close at PM, PM, AM, AM, AM and PM. Taking care of this type of detail while it might seem unimportant it can make the difference between forex 4 hour strategy and losing.

The H4 trading strategy revolves around a very forex 4 hour strategy chart pattern known to the technicians as the Doji candlestick. A detailed guide to the Doji Candlestick pattern can be found here: Best Doji Trading Strategy - The Lucky Star for Profitability.

The main characteristic of the Doji is the small body where the forex 4 hour strategy and the close are very close together. However, the hanging man, shooting star, bullish and bearish Harami, forex 4 hour strategy, inverted hammer and dark cloud are considered to be variations of the standard Doji pattern.

And, this is what makes the H4 forex trading strategy very effective. This will produce a high probability reversal setup. The truth about trading is that no matter what trading setup you use, there will always be false signals. See the best practices on how to use the stochastic indicator here: Best Stochastic Trading Strategy - Easy 6 Step Strategy.

Spotting a chart pattern is only half of the equation; we also need an entry technique for our H4 trading strategy. Every major money manager in the world uses those moving averages to make informed decisions about their portfolios.

Here is how we use the moving average :. The MA is only used for long-term guidance and to decide how long are we going to stay in the trade.

However, if the pattern develops above the MA, we want to stay with the trend and ride that wave to squeeze as much profit as possible. The 50 MA is there for guidance purposes only. What we look after is for the price to break above the 50 MA either within the first candles after we entered the market or during the development of the Doji Sandwich pattern.

First, the protective stop-loss trading strategy is placed below the Doji candle, which is the middle candle of the 3-bar pattern used. More, once we break and close above the 50 moving average, forex 4 hour strategy, the stop loss than can be trailed below the 50 MA to further reduce the risk. If the third candle closes above the high of the first candle then this is setting the stage for a very high probability trade.

In summary, the H4 forex trading strategy is ideal for looking for trading opportunities around the clock. Keep in mind that the H4 trading strategy requires a solid understanding of how the forex 4 hour strategy operates. The trading rules outlined throughout this guide should be enough to help you navigate all types of trading environments. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, forex 4 hour strategy, cryptocurrencies, commodities, and more.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow.

Best Cryptocurrency to Invest In — Our Top 4 Picks. Currency Trading Strategies that Work in — The 3 Pillars. Forex Trading for Forex 4 hour strategy. How to Trade With Exponential Moving Average Strategy. Shooting Star Candle Strategy.

Swing Trading Strategies That Work. The Best Bitcoin Trading Strategy - 5 Simple Steps Updated. What is The Best Trading Strategy To Earn A Living Updated Please log in again.

The login page will open in a new tab. After logging in you can close it and return to this page. Info tradingstrategyguides. com Facebook Twitter Instagram. Facebook Twitter Instagram. H4 Forex Trading Strategy Using the Doji Sandwich by TradingStrategyGuides Last updated Apr 30, Advanced TrainingAll StrategiesChart Pattern StrategiesForex StrategiesIndicators 0 comments. Our goal is to focus on the 4-hour time frame namely because: It allows you to actively trade the markets around the clock It combines the benefit of the intraday charts along with the big picture trends Probably the 4 hour chart is the best time frame for simple swing trading.

See below: Table of Contents hide. Author at Trading Strategy Guides Website. Search Our Site Search for:. Free Offers! Categories Advanced Training All Strategies Chart Pattern Strategies 57 Cryptocurrency Strategies 48 Forex Basics 44 Forex Strategies Indicator Strategies 69 Indicators 42 Most Popular 20 Options Trading Strategies 30 Price Action Strategies 35 Stock Trading Strategies 62 Trading Programming 5 Forex 4 hour strategy Psychology 12 Trading Survival Skills Recent Posts Trading Entry Strategies — Improve your Entries with Powerful Tricks Trading Earnings Strategy — Find the Best Opportunities for Profit TPS Trading Strategy - Time, Price, Scale-In Soybean Trading Strategies - Top 3 Methods You Need to Try ROC Trading Strategy - How to Measure Changes in Trend Speed Random Walk Trading Strategy — Are We Fooled by Randomness?

Quasimodo Trading Strategy — The Crooked Pattern from Notre Dame OHL Strategy for Day Trading NFP Trading Strategy — The Knee Jerk Reaction Mean Reversion Trading Strategy with a Sneaky Secret Limit Order Book Trading Strategy H4 Forex Trading Strategy Using the Doji Sandwich Global Macro Trading Strategies Expiry Trading Strategies - 3 New Methods Engulfing Trading Strategy - The Fade. Close dialog.

Session expired Please log in again, forex 4 hour strategy.

Forex 4 Hour Trading Strategy Explained - Easy Beginner Strategy

, time: 9:12

13/1/ · The 4-hour time frame is an intraday TF where each corresponding candle encompasses exactly 4 hours of trading activity from open to close. The 4h chart also comes as the standard default time-frame with most top trading platforms so, it’s readily accessible. The 4h time frame carries a distinctive role, especially in the forex market Our Very Profitable 4 Hour Chart Trend Following Strategy With this strategy, the main goal is to exploit the popular saying in the trading world “the trend is your friend”. This swing trading strategy uses a combination of moving averages, support and resistance, volatility and a few other tools to maximize profits from the trends in the Forex market 10/1/ · Here are a few additional tips you can use when swing trading the 4hr charts: Have the daily chart as your ‘ higher ‘ time frame context. When in doubt, try to trade with this the most. Don’t expect the market to go straight to your target. NOTE: It may require a few pullbacks before it gets there

No comments:

Post a Comment